How the world’s smelliest fruit makes coffee more expensive

Getty Images

Getty ImagesHow much is too much for a caffeine fix?

Prices like £5 in London or $7 in New York for a cup of coffee may be unthinkable to some – but they could soon become a reality thanks to a “perfect storm” of economic and environmental factors in the world’s leading coffee-producing regions.

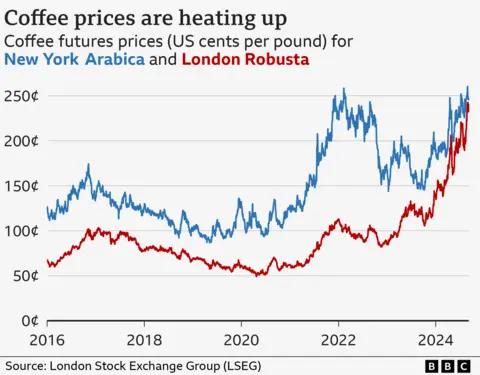

The cost of unroasted beans traded on world markets is now at “historical highs”, analyst Judy Ganes said.

Experts blame a mix of problematic crops, market forces, large amounts of depleted stock – and the world’s smelliest fruit.

So how did we get here, and how much impact will it have on your morning latte?

In 2021, a rare frost wiped out coffee plants in Brazil, the world’s largest producer of Arabica beans – those commonly used in barista-made coffee.

This shortage of beans meant that consumers turned to countries like Vietnam, the main producer of Robusta beans, which are used mainly in quick mixes.

But farmers there faced the region’s worst drought in nearly a decade.

Climate change has affected the development of coffee crops, according to Will Firth, a coffee consultant based in Ho Chi Minh City, which has also affected the bean harvest.

And Vietnamese farmers turned to the fragrant, yellow fruit – durian.

Getty Images

Getty ImagesFruit – which public transport is banned in Thailand, Japan, Singapore and Hong Kong because of its aroma – it seems to be popular in China.

And Vietnamese farmers are replacing their coffee crops with durian to cash in on this emerging market.

Vietnam’s durian market share in China is expected to nearly double between 2023 and 2024, and some estimate that the crop is five times more profitable than coffee.

“There is a history of farmers in Vietnam who are volatile due to market price fluctuations, over-committing, and flooding the market with their new crop,” said Mr Firth.

As they flooded China with durian, exports of Robusta coffee dropped by 50% in June compared to last June, and stocks were now “running out”. according to the International Coffee Organization.

Exporters in Colombia, Ethiopia, Peru and Uganda have increased, but have not yet produced enough to ease the tight market.

“That’s right [the] the time when things started to stabilize with the demand for Robusta, was right when the world wanted more supply,” Ms. Ganes explained.

This means that Robusta and Arabica beans are now trading at near record highs in commodity markets.

Brewing market storm

Do fluctuations in the global coffee economy affect the price of your coffee on the high street? Short answer: it’s possible.

Retailer Paul Armstrong believes coffee drinkers could soon face the “crazy” prospect of paying more than £5 in the UK for their caffeine fix.

“The perfect storm right now.”

Mr Armstrong, who runs East Midlands-based Carrara Coffee Roasters, imports beans from South America and Asia, which are then roasted and shipped to restaurants in the UK.

He tells the BBC he recently raised his prices, hoping to cover higher prices – but says costs have “come up” since then.

He adds that since some of his contracts will expire in the coming months, the cafes he works in will soon have to decide whether to pass on the higher costs to their customers.

Mr Firth says some parts of the industry will be more exposed than others.

“It’s really a lot of coffee that’s going to experience a lot of disruption. Instant coffee, supermarket coffee, gas station stuff — all of that is going up.”

Industry figures warn that the high market price of coffee may not translate into high sales prices.

Felipe Barretto Croce, CEO of FAFCoffees in Brazil, admits that consumers are “feeling shortchanged” as consumer prices have risen.

But he says that is “mainly due to general inflationary costs”, such as rent and labour, rather than the cost of beans. Consultancy Allegra Strategies estimates that beans contribute less than 10% of the value of a cup of coffee.

“Coffee is still very cheap, as a luxury, if you make it at home.”

He also says that the rising cost of low-quality beans means that high-quality coffee may now be seen as better value.

“If you go into a specialty coffee shop in London and get coffee, compared to coffee at Costa Coffee, it’s different [in price] between that cup and specialty coffee is much less than before.”

But there is hope that the price will decrease.

Loss of future foundation

The upcoming spring harvest in Brazil, which produces a third of the world’s coffee, is now “important”, according to Mr Croce.

“What everyone is looking at is when the rains will return,” he said.

“If they come back early, the plants should be healthy enough and the flowering should be good.”

But if the rains come in late October, he adds, next year’s crop yield forecasts will fall and market pressure will continue.

In the long term, climate change poses major challenges to the global coffee industry.

Getty Images

Getty ImagesA learn from 2022 concluded that even if we significantly reduce greenhouse gas emissions, the area most suitable for growing coffee could decrease by 50% by 2050.

One step to future-proof the industry Mr. Croce supports is the “green fee” – a small tax on coffee that is given to farmers to invest in regenerative agriculture, helping to protect and sustain farm efficiency.

So while the aromatic fruit is driving up prices now – a changing climate could put pressure on coffee’s availability in the years to come.

Source link